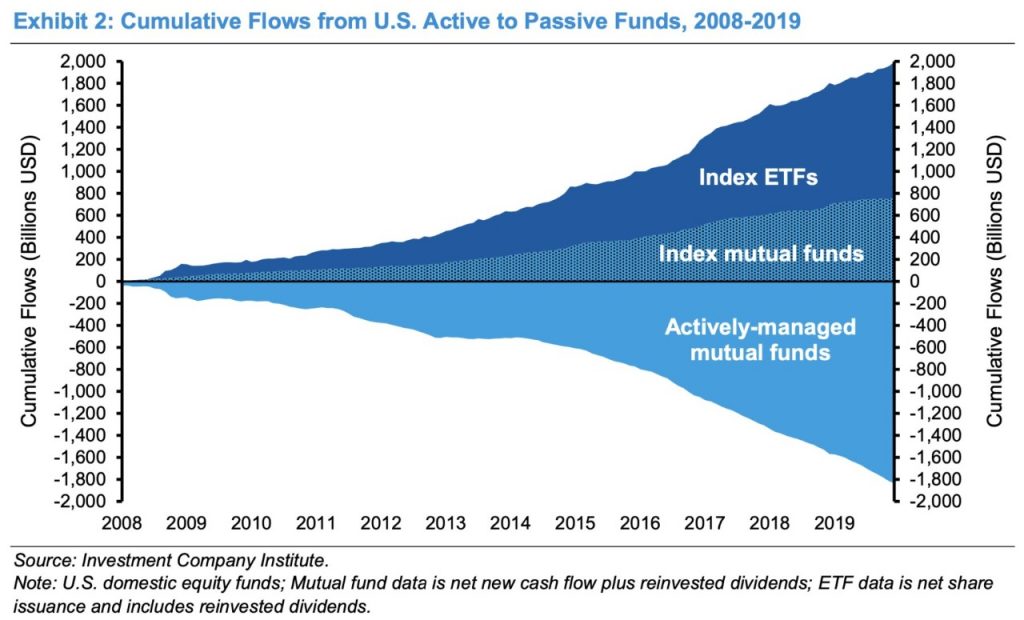

Move from Active Managed Funds to Passive ETFs

This trend should accelerate in India also going forward. Move from actively managed MFs to low cost ETFs # Mutual Funds # Nifty

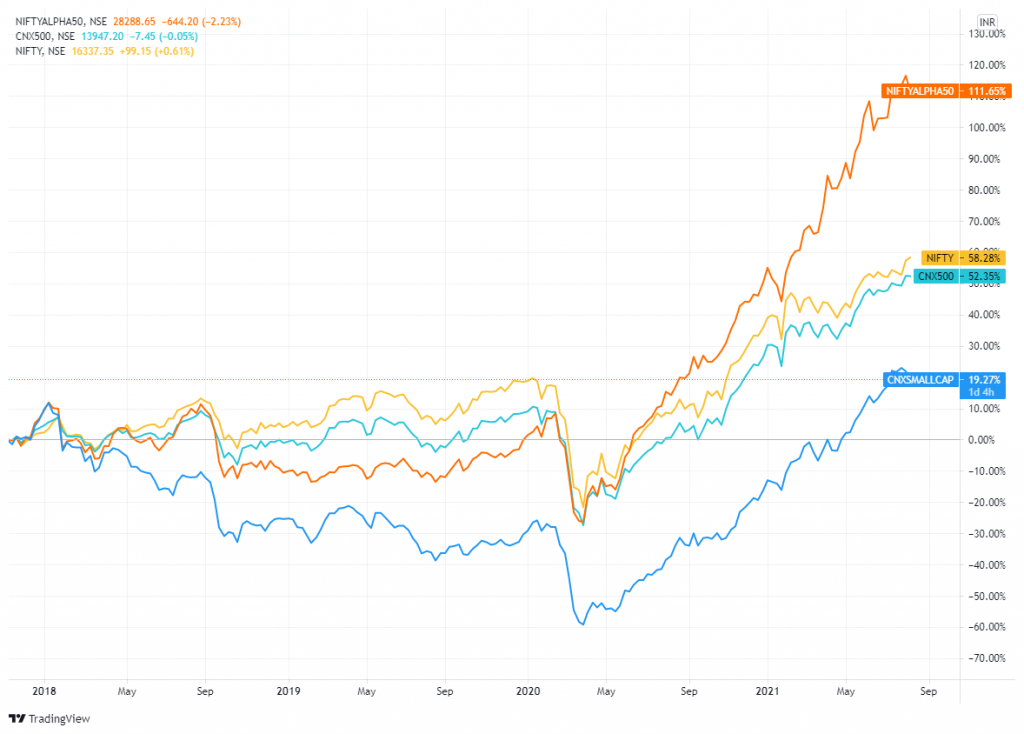

It’s all about Alpha!

There has been a lot of talk lately about rotation between largecaps and smallcaps. As we have discussed, each one has its own sweet phase. Smallcap investors typically are ready for higher risk (drawdowns), in the search for higher gains. However there is an index which creates more Alpha. It is the Nifty Alpha 50. […]

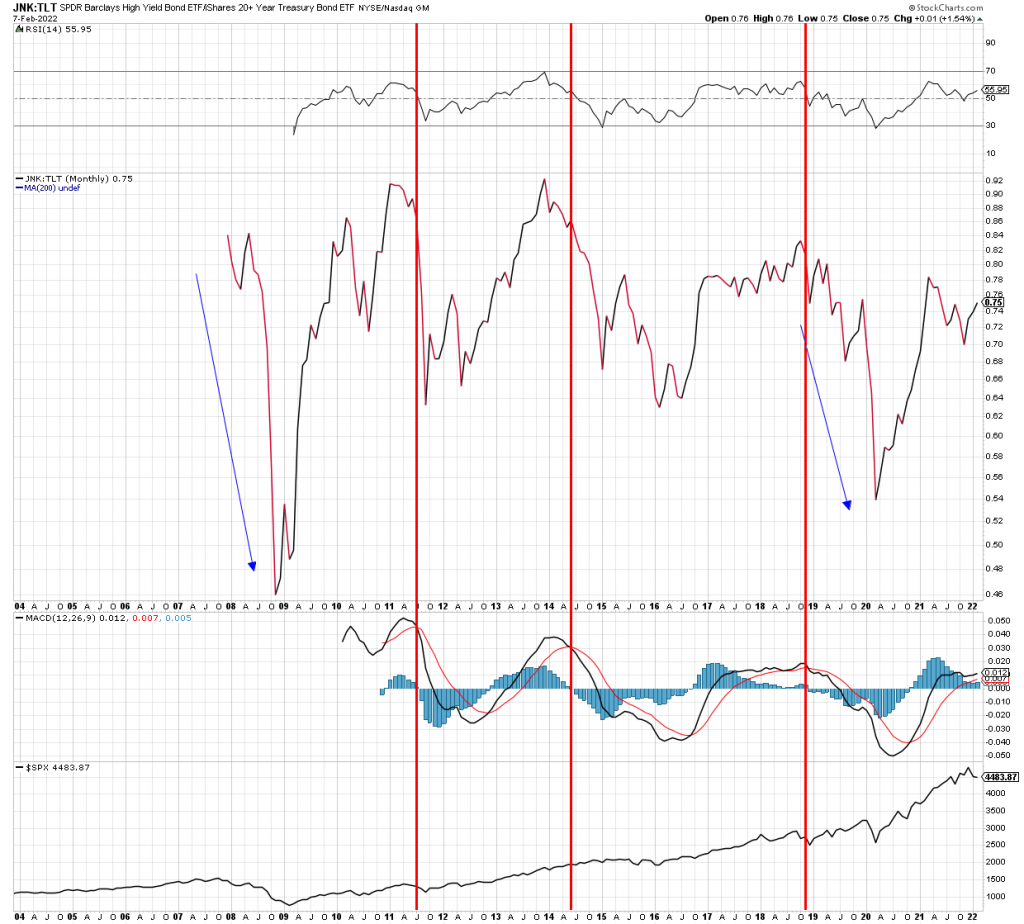

High Yield markets suggest no major worry ahead

One very useful tool to gauge the future trend is to see the high yield market. When there is genuine fear and risk aversion, the high yield market factors that in and prices fall. See the monthly chart of high yield vs Treasury Bonds. In periods like 2008, 2020 high yield prices crashed relative to […]

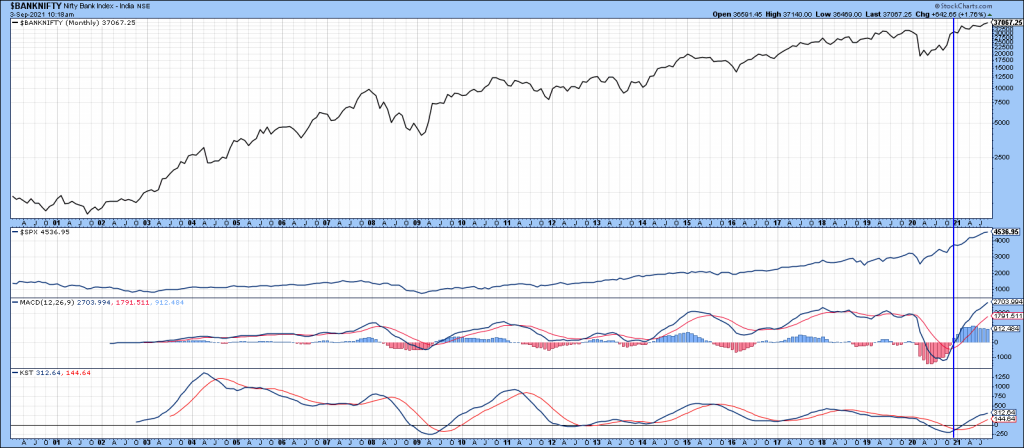

Bank Nifty Breakout Imminent

While Nifty has been blasting in recent weeks, Bank Nifty’s move has been anaemic in comparison. However a huge move in Bank Nifty is imminent. First, see the longer term chart of Bank Nifty below: It is in a clear Uptrend based on the Monthly KST. Next look at the shorter term chart. It has […]

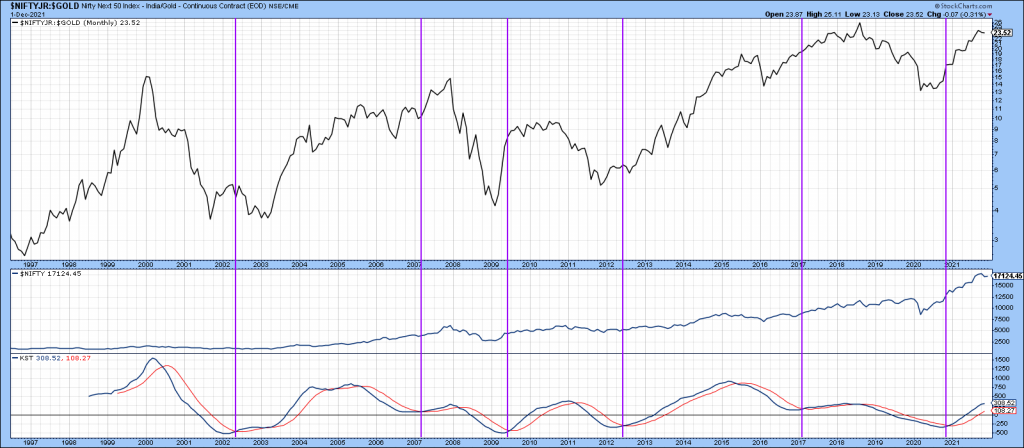

Equities vs Gold

There is a time to belong to Equities and a time to belong to Gold. Both these assets are negatively correlated i.e. when equities fall and there is fear on the street, Gold rallies. A good asset allocation can belong for both Equities and Gold to reduce drawdowns but we will talk about that later. […]

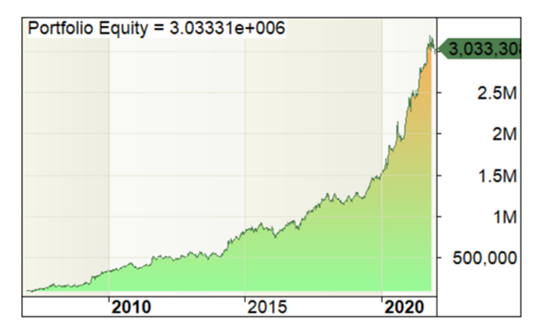

Equity and Gold Rotation system

Equity and Gold are negatively correlated. Here is a system that takes advantage of that. Rotation between Nifty Next 50 Index and Gold Bees. Very low maintenance – hardly 1-2 trades a year. 26% CAGR with 22% drawdown. The drawdown curve is shown here: Very smooth equity curve: Logic behind this is when there is […]