There has been a lot of talk lately about rotation between largecaps and smallcaps. As we have discussed, each one has its own sweet phase. Smallcap investors typically are ready for higher risk (drawdowns), in the search for higher gains.

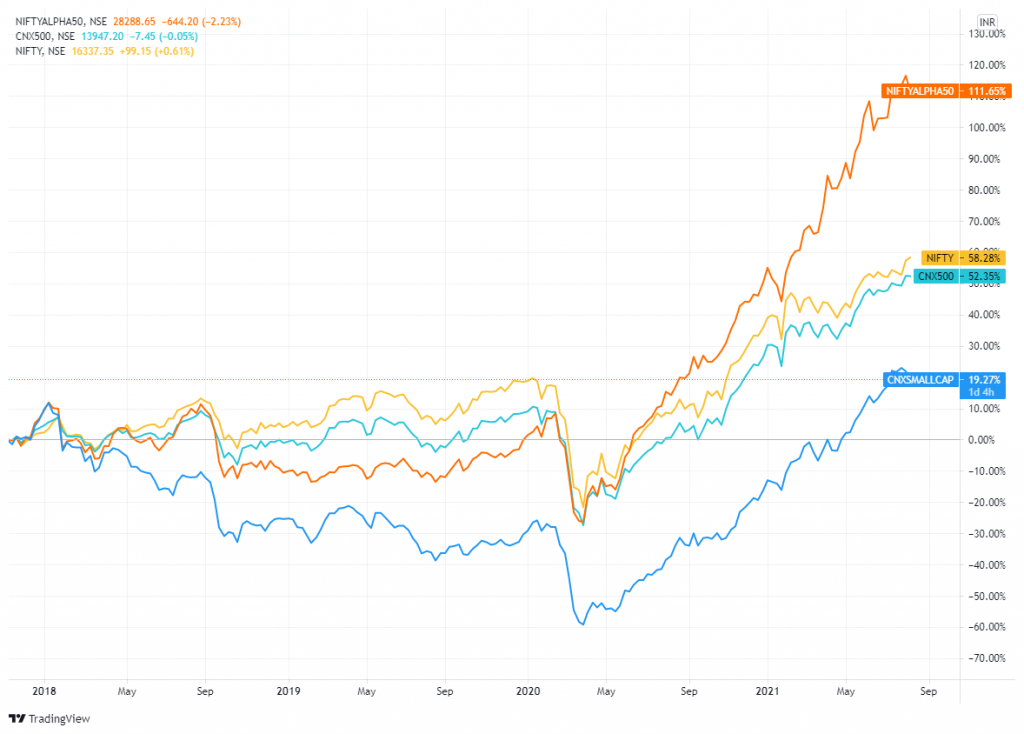

However there is an index which creates more Alpha. It is the Nifty Alpha 50. See the chart below of the returns from 2018 when the markets topped out.

Nifty 50 has given 58%, Smallcap Index 100 has given 19% whereas Nifty Alpha 50 has given a whopping 111%

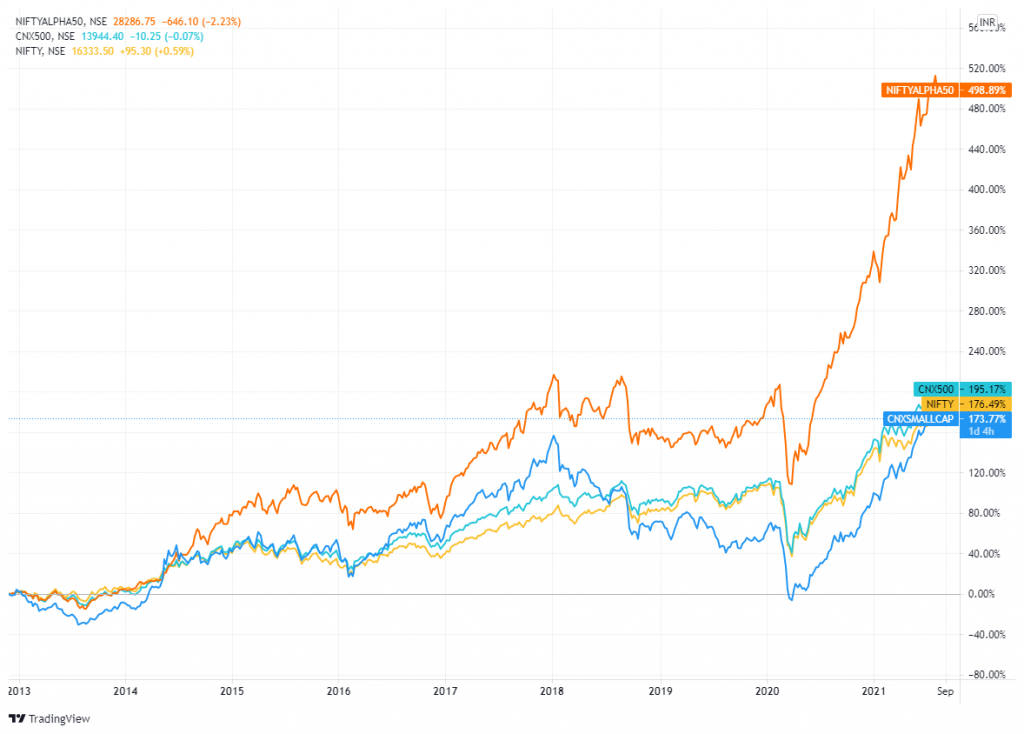

If we analyse from 2013, before the Modi bull market the picture is similar. Nifty has given 176%, Nifty Smallcap 100 has given 173%, Nifty Alpha 50 has given 498%.

This is serious outperformance. Most actively managed mutual funds, PMSs have not been able to match this performance. Investors should look at having this index as part of their overall asset allocation.