There is a time to belong to Equities and a time to belong to Gold. Both these assets are negatively correlated i.e. when equities fall and there is fear on the street, Gold rallies.

A good asset allocation can belong for both Equities and Gold to reduce drawdowns but we will talk about that later. How do we know when to be long Equities and when to be long Gold?

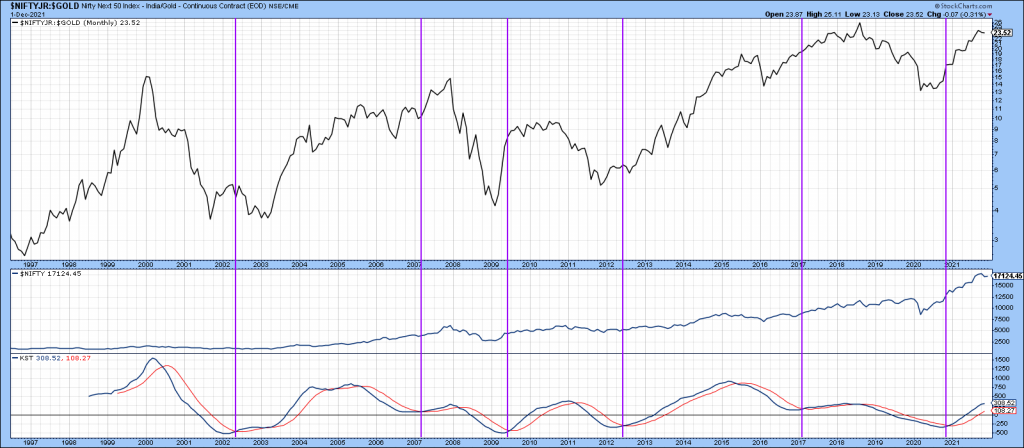

This a monthly chart of Nifty Junior vs Gold. It has the KST Indicator. Observe when we got a positive crossover implying to go long in Equities. 2002. 2007, 2009, 2012, 2017 and 2020. This is a slow indicator and gives an indication when we can be really bullish equities. It is a full on risk environment and typically smallcaps and momentum counters go through the roof. Riding 3-4 of these moves can make enough wealth to last a lifetime.

Currently we are in that phase which is still bullish equities. It may come to an end soon but it hasn’t yet. Stay long and enjoy the ride.