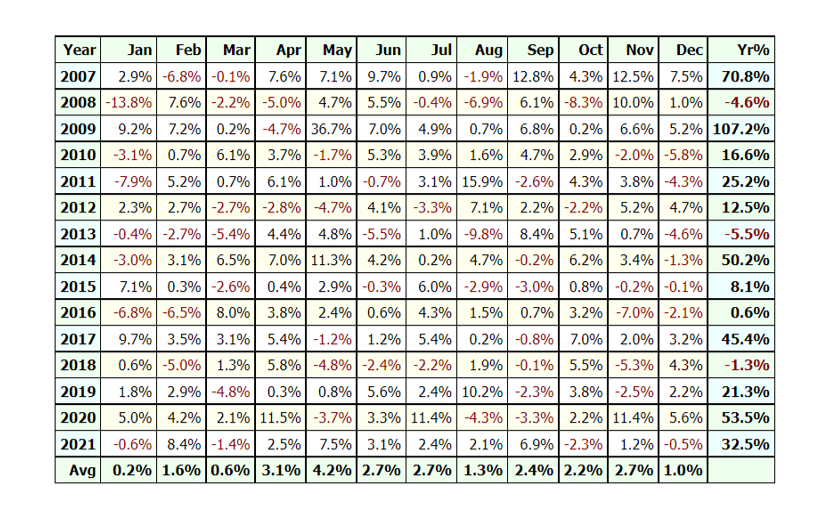

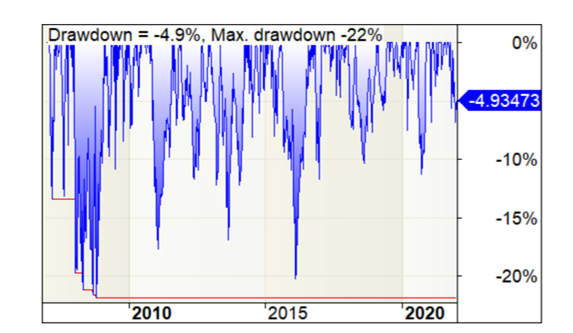

Equity and Gold are negatively correlated. Here is a system that takes advantage of that. Rotation between Nifty Next 50 Index and Gold Bees. Very low maintenance – hardly 1-2 trades a year. 26% CAGR with 22% drawdown.

The drawdown curve is shown here:

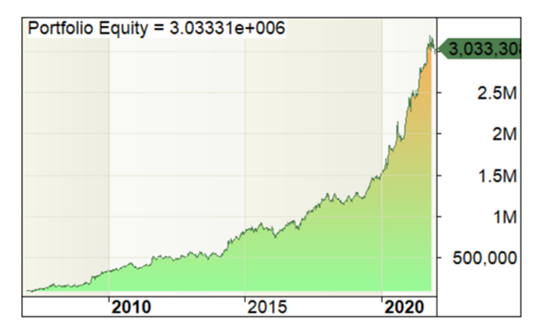

Very smooth equity curve:

Logic behind this is when there is fear and risk off environment: equity falls and gold zooms.

Investing is simple but emotionally tough. How many people will sell all their equity and invest 100% in gold? Very few. But this is a peace of mind way of getting huge returns with low drawdowns. No hassle of individual stocks, fundamental analysis and individual stock research, tracking the markets etc.

The method is very scalable also. One-two trades a year and that too on index funds. Can trade big money on this. Perfect for Ultra HNIs and Family Offices.